Amber Walliser

Amber WalliserA few days after Donald Trump won the US presidential election, Amber Walliser stocked up, spending $2,000 (£1,538) on appliances she believed would get more expensive as the White House started to put new taxes on imports.

But that was a temporary splurge. These days, her family is buckling down, worried about job security, and a possible economic downturn, which experts believe could be more likely because of US President Donald Trump’s tariffs.

It means no new car, or big vacation this year. They have even shelved plans to start trying for a second child.

“We are saving as much as possible, just hoarding cash, trying to bulk up our emergency fund,” the 32-year-old accountant from Ohio said.

Amber’s worries are being echoed across the US, as tariffs and other changes by the White House hit the stock market, spark turmoil for businesses, and add to inflation concerns.

That is the tricky scenario that officials at the US central bank will have to address at their interest rates meeting on Wednesday.

The Federal Reserve, which is supposed to keep both prices and employment stable, typically lowers borrowing costs to help support the economy, or raises them to slow down price rises, as it did when prices shot up in 2022.

Though analysts widely expect the Fed to leave interest rates unchanged on Wednesday, they are far more divided about what to expect in the months ahead, as tariffs could both raises prices and slow economic growth.

“Their job has become a lot harder,” said Jay Bryson, chief economist at Wells Fargo.

In a speech earlier this month, the head of the Federal Reserve, Jerome Powell, noted that surveys of sentiment have not been good indicators of spending decisions in recent years, when the economy has performed well across many mainstream metrics, despite sour views.

He said policymakers could afford to wait to see the overall impact of the White House policy changes before responding.

Dave Gold

Dave GoldBut households are responding to the uncertainty now.

After his investments were hit in the recent stock market sell-off, Dave Gold drew up a budget and started slashing his spending.

He cancelled Netflix, challenged himself to avoid Amazon purchases for a month, and scaled back his travel, managing to cut his expenses in half.

“It’s just really hard to plan and be confident about what next month looks like,” said the 37-year-old, who lives in Wyoming and works in finance.

“I thought it was time to reel it back in and protect myself in case things do happen.”

Dave is not the only American reigning in their spending. Retail sales also fell last month, while firms from Walmart to Delta Air Lines have warned of slackening demand.

Meanwhile, job growth has slowed and the stock market is now trading at its lowest levels since September.

In this month’s survey of consumer sentiment by the University of Michigan, concerns about the job market surged to the highest level since the Great Recession, while household expectations of long-term inflation also jumped, in the biggest one-month rise since 1993.

Those are troubling signals for the US, in which consumer spending accounts for roughly two thirds of the economy.

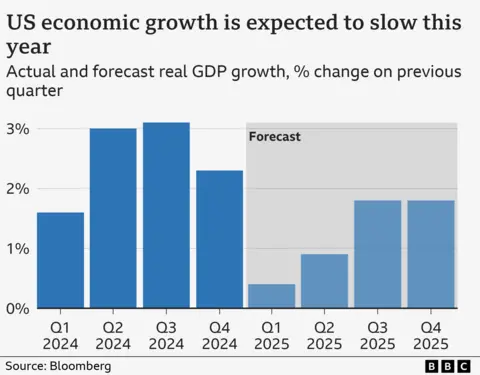

“It’s not like the consumer is falling apart, but we’re seeing some cracks,” said Mr Bryson, who puts the odds of a recession at one in three, up from one in five at the start of the year.

“If consumers retrench…the entire economy is going to go down with it,” he said.

Getty Images

Getty ImagesWhite House officials have acknowledged the likelihood of “a little disturbance”, while promising that the short-term pain will lead to long-term gain.

But polls suggest Trump’s handling of the economy is a point of concern for the public, especially for Democrats and independents, but increasingly for Republicans as well.

Software engineer Jim Frazer, who did not vote for Trump, said the administration’s assurances have done little to ease his concerns, as he sees policies change by the hour, the stock market sink, and prices for staples such as eggs rise.

Around the end of last year, the 49-year-old, who lives in Nebraska, purchased a new phone and television, betting such items would be affected by the tariffs Trump said he planned to put on imports from China.

More recently however, he’s trying to cut back, both as a buffer against rising costs and because he has been spooked by the Trump administration’s talk – not just about tariffs, but other moves, like annexing Canada as the 51st state.

He and his wife recently hit pause on their plan to replace an old loveseat, and have scaled back their ambitions for renovating the bathroom.

“I just feel like right now, we need that money squirrelled away in a safe spot,” he said.

“It’s that feeling like we’re heading towards something and we’ve got to get prepared.”